The Golden Stream Flowing Westward

In the intricate dance of global energy transitions, an unexpected protagonist has emerged: India’s used cooking oil (UCO). Once discarded as waste, this viscous liquid now fuels a transcontinental partnership reshaping renewable landscapes. By 2024, India had positioned itself as Europe’s critical UCO supplier, exporting over 500,000 metric tons annually—enough to power 1 million EU trucks 2. This surge isn’t accidental; it’s the result of deliberate policy architectures, market realignments, and sustainability imperatives converging across hemispheres.

Europe’s thirst for waste-based biofuels intensifies as its Renewable Energy Directive (RED III) mandates 14% renewable transport fuels by 2030—requiring 45 million metric tons of biodiesel. Yet, Europe generates only 40% of its UCO needs domestically. Enter India: with its 3.2 million metric tons of collectable UCO annually (projected to reach 4.5 million MT by 2030), it’s bridging this gap while turning waste into geopolitical leverage

Section 1:

The Policy Engines Driving India’s UCO Mobilization

1.1 RUCO: India’s Waste-to-Wealth Catalyst

India’s Repurpose Used Cooking Oil (RUCO) initiative, launched by the Food Safety and Standards Authority (FSSAI), has transformed UCO from an environmental hazard into a national asset. The program’s brilliance lies in its multi-pronged approach:

Mandatory tracking: Requiring food businesses to maintain UCO disposal records

Collection incentives: Establishing buyback rates 2-3x higher than waste oil prices

Blending mandates: Setting a 5% biodiesel (B5) target by 2030 15

This framework formalized an otherwise fragmented sector. By 2024, over 200,000 eateries participated, with major chains like McDonald’s India contributing 1,500+ MT annually. The government further sweetened the deal with GST exemptions on biodiesel equipment and capital subsidies covering 30% of plant costs 3.

1.2 China’s Retreat Creates India’s Opening

China’s elimination of its 13% export tax rebate in December 2024 reshuffled Asia’s UCO dynamics overnight. Historically, China supplied 40% of Europe’s UCO imports, but the policy shift redirected volumes toward domestic SAF production. Chinese exports to Europe plummeted by 70,000 metric tons within months 211.

India seized this vacuum. Leveraging lower logistics costs and diplomatic channels like the Global Biofuels Alliance (GBA), Indian suppliers captured 28% of Europe’s import market by Q1 2025—up from 9% in 2023 15.

1.3 The Transcontinental Regulatory Bridge

Europe’s regulations inadvertently favor Indian UCO:

RED III’s Annex IX: Grants double-counting incentives for waste feedstocks

Anti-dumping bypass: Unlike palm/crop-based biofuels, UCO faces no EU tariffs

FuelEU Maritime: Mandates 6% GHG reduction in ship fuels by 2030, favoring UCOME 11

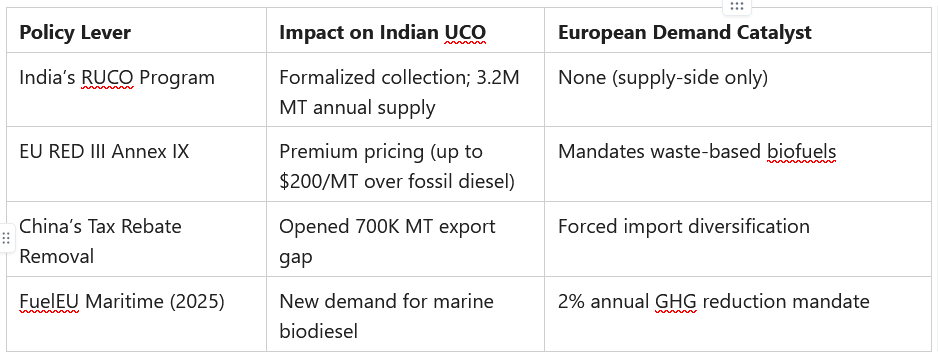

Table: Policy Drivers Accelerating India-EU UCO Trade

Section 2:

The Green Gold Rush – Market Mechanics Unpacked

2.1 The Price Premium Powering the Trade

- Cost: At $990–$1,030/MT FOB India, it’s 20–30% cheaper than virgin oils 2

- Carbon Savings: 83% lower emissions than fossil diesel (ISO 14064 certified) 13

- Policy Arbitrage: Double-counting in EU systems multiplies compliance value

2.2 Collection Innovations: Tech Tackling the ‘Last Fryer’ Problem

- AI-Powered Routing: Startups like EcoFuel use machine learning to optimize truck routes across 100,000+ eateries, cutting collection costs by 40%

- Blockchain Traceability: IBM-backed platforms timestamp UCO from collection to port, satisfying EU’s mass balance requirements

- Community Microhubs: Women’s self-help groups in Punjab and Maharashtra aggregate rural UCO, connecting 500+ villages to export pipelines 13

Section 3:

Environmental Calculus – The Carbon Math Behind the Trade

3.1 Why Europe Pays for India’s Waste

- 1 MT Indian UCO in EU Trucks = 2.8 MT CO₂e Avoided

- Breakdown:

- Avoided methane from landfill decay: 0.5 MT CO₂e

- Displaced diesel emissions: 2.3 MT CO₂e

- Breakdown:

- Water Saved: Prevents contamination of 6 million liters per MT 13

3.2 The Fraud Risk – Palm Oil’s Shadow Looms

- FSSAI’s RFID Tracking: Mandatory chips on UCO containers

- Isotopic Testing: Labs in Mumbai verify fossil fuel contamination <0.5%

- EU Audits: Unannounced inspections at Indian processing plants

Section 4:

The Industrial Ecosystem – Players, Technologies, and Value Chains

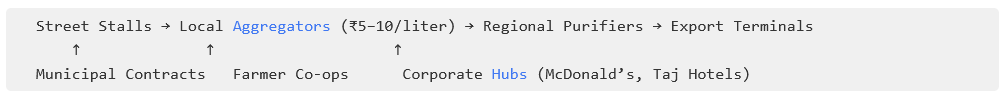

4.1 From Street Vendors to SuperTankers: India’s UCO Value Web

4.2 Refining Innovations Unlocking Value

- Enzymatic Transesterification: Using immobilized lipases to boost yields to 98%

- Nanofiltration: Graphene membranes remove water content to <0.075%

- Glycerin Recovery: Converting byproducts into pharmaceuticals-grade materials

Section 5:

The Road Ahead – Challenges and Frontiers

5.1 The Gathering Storm Clouds

- EU’s 45Z-Style Proposals: Potential U.S.-style subsidies for domestic feedstocks could disadvantage imports 11

- India’s Domestic Demand: Rising biodiesel mandates may absorb export volumes

- Logistics Chokepoints: Red Sea disruptions increased shipping costs 300% in Q1 2025 11

5.2 The SAF Frontier – From Trucks to Jets

- India’s SAF Target: 1% blending by 2027 (∼150,000 MT/year) 15

- Conversion Economics: UCO-to-SAF commands $400/MT premiums over road biodiesel

- Strategic Moves: IndianOil’s new 100,000 MT SAF plant will source exclusively from UCO

5.3 Ideation: A Truly Circular Bioeconomy

- Bilateral Carbon Accounting: EU recognizes emission reductions in India’s territory

- Bio-Refinery Joint Ventures: European firms co-locate plants near Indian collection zones

- UCO-Biogas Hybrids: Integrate with India’s CBG mandates for cascading energy recovery

*Note: Soy values include iLUC risks; UCO has near-zero iLUC. Sources: 213