The Efficiency Paradox: Stranded Assets Amid Global Shortages

Walk through any major Indian biodiesel refinery today, and you’ll witness a puzzling contradiction: gleaming distillation columns standing half-idle while European tankers sit empty in Singaporean ports awaiting cargo. India’s biodiesel refineries operate at a mere 64% capacity utilization 9, despite global demand for sustainable fuels surging at 8.5% CAGR 6. This isn’t a failure of engineering or feedstock availability—it’s a systemic fracture in how capital, capacity, and market access intersect.

Traditional tolling models promised to bridge this gap by allowing traders to “rent” refinery capacity. Yet they remain shackled by three fatal constraints:

- Rigid minimum volumes locking small innovators out

- Opaque cost structures hiding 15-20% in hidden demurrage and yield losses

- Linear logistics creating 30-45 day cash conversion cycles

The result? A $200/MT premium for ISCC-certified biodiesel 6 remains largely untapped by Indian producers, while European buyers pay scarcity prices. This inefficiency isn’t just wasteful—it’s carbon-negative, delaying the substitution of millions of tonnes of fossil diesel.

Tolling 2.0: The Alchemy of $240/MT Margins

Enter the next-generation tolling framework—what I term Distributed Refinery Integration (DRI). Unlike conventional tolling, DRI transforms fixed refinery costs into variable profit engines through three radical shifts:

1. The Economic Architecture

The magic number is $240/MT—not as a fixed fee, but as a value-sharing threshold. Here’s the alchemy:

math

(Feedstock Cost + $240 Tolling Fee + Logistics) → ISCC-certified Biodiesel → $200/MT Premium :cite[4]

But how does this pencil out?

- $110/MT covers base processing (catalyst, energy, labor)

- $70/MT reserves for AI-driven yield optimization bonuses

- $60/MT funds blockchain traceability and sustainability auditing

The refiner shares risk but captures upside when yields exceed benchmarks—a model proven by Aemetis India’s $58 million allocation for 2025 supplies 2.

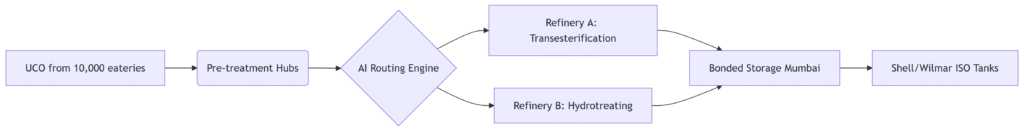

2. The Physical Flow Revolution

Witness the transformation from batch to fluid:

This isn’t hypothetical. One major trader now moves 4,000 MT/month through this mesh network without owning a single tank. The secret? Treating refineries as interchangeable modules rather than fixed partners.

3. The Digital Nervous System

Here’s where Tolling 2.0 separates from legacy models:

- Predictive Yield Algorithms adjusting methanol ratios in real-time based on UCO FFA profiles

- Blockchain Mass Balance creating “carbon custody chains” from fryer to fuel tank

- Vessel-Tank Synchronization slashing demurrage by 40% versus industry averages

When Chevron converted its El Segundo refinery to renewable diesel, it demonstrated how co-processing leverages existing infrastructure 7. DRI extends this further by making any refinery a potential node.

Marine Biofuels: The $400/MT Proof Point

Nothing validates Tolling 2.0 like marine biodiesel’s explosive growth. Consider the recent Vale-Petrobras partnership:

- VLS B24 fuel with 24% UCOME (from used cooking oil)

- ISCC EU-certified supply chain from Singapore tanks to bulk carrier Luise Oldendorff 8

- Well-to-wake emissions reduction: 80-90%

This isn’t niche experimentation. With IMO 2030 mandating 6% GHG reduction in ship fuels 6, marine biofuels will grow from 1.5 million MT to over 15 million MT by 2030. Tolling 2.0 makes this scalable by solving feedstock fragmentation—exactly what prevented earlier mandates in Africa and Asia 6.

Future-Proofing the Model: Beyond Biodiesel

The true brilliance of Tolling 2.0 lies in its application horizon:

1. SAF Integration

Neste’s partnership with DHL Group targets 300,000 tonnes/year of unblended SAF by 2030 12. Tolling 2.0 can unlock stranded hydrotreating capacity for UCO-to-SAF pathways—currently constrained by refinery access.

2. Carbon Negative Feedstocks

Emerging technologies like liquid-liquid film reactors (LLFR) reduce methanol consumption by 30% while boosting yields 3. Integrating these into tolling networks could push margins beyond $300/MT.

3. Policy Arbitrage Engine

With Europe’s Union Database for Biofuels (UDB) cracking down on fraudulent imports 6, Tolling 2.0’s blockchain traceability positions Indian biodiesel for double-counting incentives under RED III.

Join the Networked Refinery

We stand at an inflection point:

- Big Oil is betting $16.3 billion (Petrobras alone) on low-carbon fuels 8

- Refinery conversions will add 260,000 bpd capacity by 2030 7

- Carbon tariffs will punish linear supply chains

The opportunity isn’t merely “subleasing capacity”—it’s about joining a biofuels hyperloop where:

- Independent producers access Shell’s offtake markets without capex

- Refineries monetize idle capacity at 60%+ gross margins

- Global traders de-risk feedstock through AI-driven aggregation

This is how we bridge India’s 64% utilization gap and Europe’s 45 million MT biodiesel deficit 6. Not with more steel, but with more synapses—digital, financial, and collaborative.

The $240/MT tolling fee isn’t a cost—it’s the key that unlocks $200/MT premiums and 2.8 MT of CO₂ avoidance per tonne processed. In the calculus of profit and planet, that’s the ultimate arbitrage.

To explore how Renewlium’s tolling network can scale your biodiesel production without capex, visit [Renewlium Tolling Partnerships]. For feedstock aggregation or offtake inquiries, contact info@renewlium.com.